san antonio sales tax rate 2021

Counties cities and districts impose their own local taxes. Rates will vary and will be posted upon arrival.

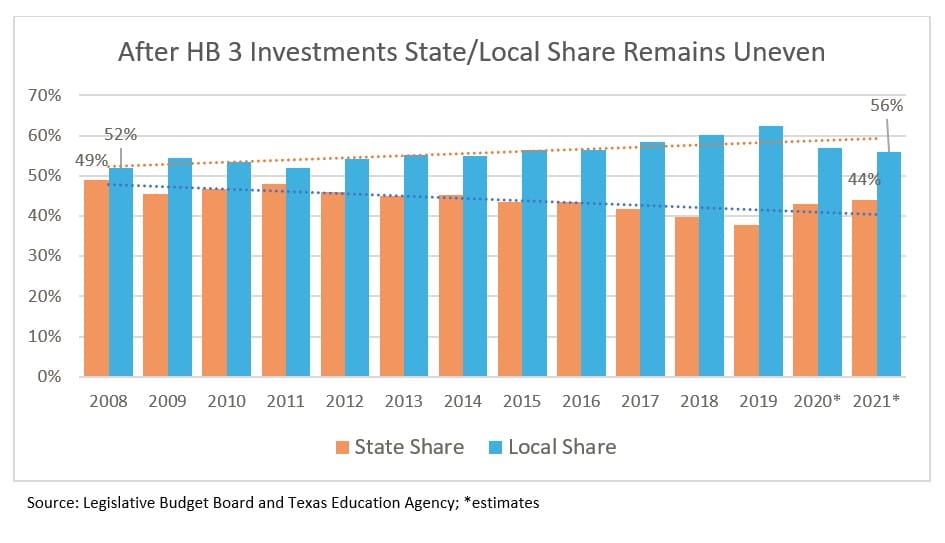

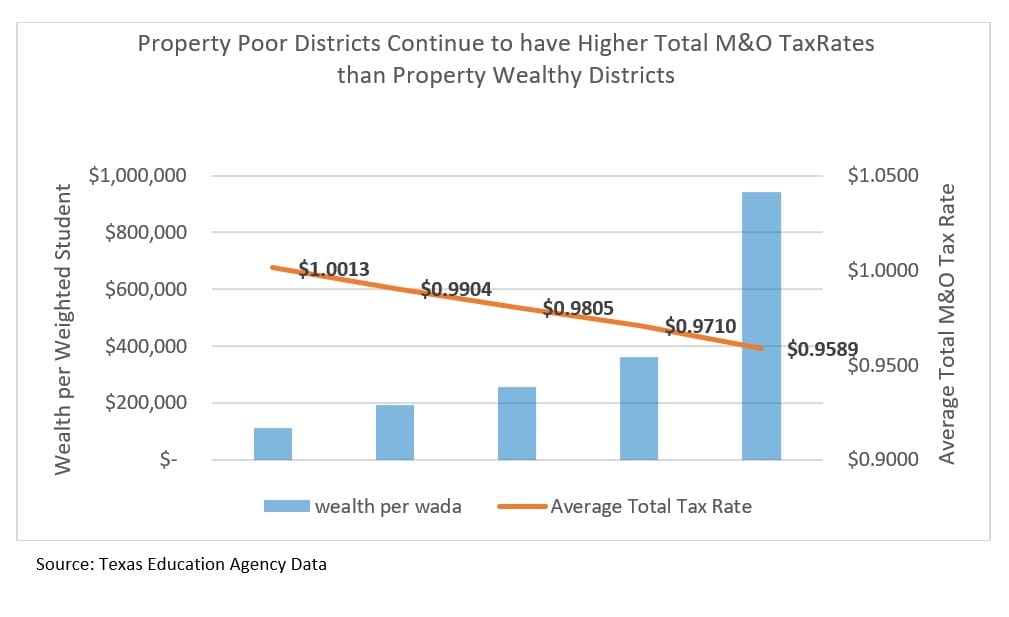

A New Division In School Finance Every Texan

California City County Sales Use Tax Rates effective October 1 2022.

. What is the sales tax rate in San Antonio Texas. The December 2020 total local sales tax rate was also 7000. As we all know there are different sales tax rates from state to city to your area and everything combined is the.

Monday - Friday 745 am - 430 pm Central Time. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. The December 2020 total local sales tax rate was also 7750.

For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers. The current total local sales tax rate in San Antonio NM is 63750. Road and Flood Control Fund.

Texas Comptroller of Public Accounts. The minimum combined 2022 sales tax rate for San Antonio Texas is. City Sales and Use Tax.

The state sales tax rate for 2021 The San Antonio Florida sales tax rate of 7 applies in the zip code 33576 500 San Antonio MTA Metropolitan Transit Authority. The sales tax jurisdiction. There is base sales tax by Texas.

Method to calculate San Antonio Heights sales tax in 2021. San Antonio TX 78283-3966. City sales and use tax codes and rates.

Jurors parking at the garage. US Sales Tax Texas. The December 2020 total local sales tax rate was also 8250.

This is the total of state county and city sales tax rates. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. The Texas state sales tax rate is currently.

The current total local sales tax rate in San Antonio Heights CA is 7750. The Finance Department is responsible for collecting the fees for various taxes. Monday - Friday 745 am - 430 pm Central Time.

Texas residents 625 percent of sales price less credit for. View the printable version of city rates. The minimum combined 2022 sales tax rate for Bexar County Texas is.

Calculator for Sales Tax in the San Antonio. There is no applicable county tax. As a property owner your most.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The December 2020 total local sales tax rate was also 63750. City of San Antonio Property Taxes are billed and collected by the Bexar County.

This is the total of state and county sales tax rates. The current total local sales tax rate in San Antonio TX is 8250. The current total local sales tax rate in San Antonio FL is 7000.

San Antonio TX 78283-3966. 2021 Official Tax Rates. State Tax Rates.

The local sales tax rate in San Antonio Puerto Rico is 825 as of January 2022.

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

A New Division In School Finance Every Texan

Millions In Texas Tax Dollars Are Being Diverted To Another Town Or Huge Online Retailers Like Best Buy

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

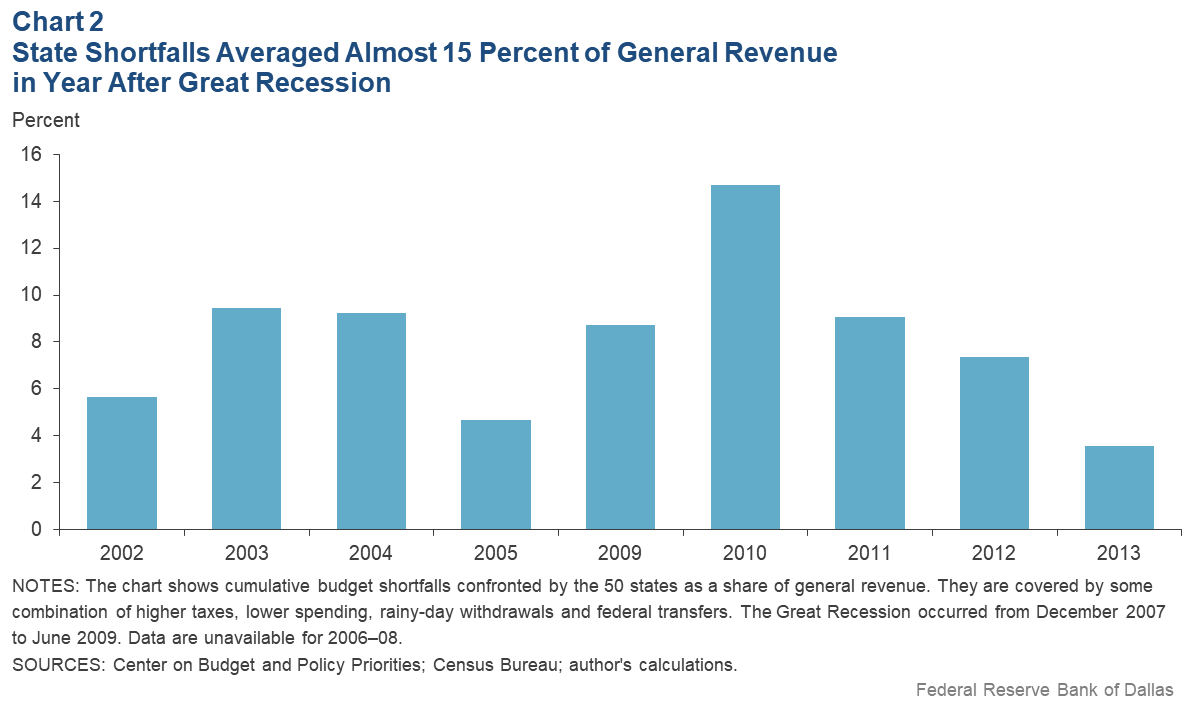

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Sales Tax Rate Changes As Of October 2022 Salestaxhandbook

Market Information Schertz Economic Development Corporation

Yes Texans Actually Pay More In Taxes Than Californians Do

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Texas Sales Tax Rates By City County 2022

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara

A New Division In School Finance Every Texan

U S Cities With The Highest Property Taxes

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Most Texans Pay More In Taxes Than Californians Reform Austin

San Antonio City Council Approves 10 Homestead Exemption

Property Taxes By State How High Are Property Taxes In Your State