jersey city property tax phone number

Web If the assessment on a property is 1 million or below a taxpayer must first file an appeal with the county board of taxation. Jersey Citys average tax rate is currently 17 which is slightly lower than the New Jersey state average.

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Web Hudson County Board Of Taxation Suggest Edit.

. Web How much property tax is collected in Jersey City. See reviews photos directions phone numbers and more for Jersey City Property Tax locations in. Under Tax Records Search.

In Person - The Tax Collectors office is open 830 am. Eduardo CToloza CTA City Assessor. Left click on Records Search.

Web Automated Phone Numbers. Web TO VIEW PROPERTY TAX ASSESSMENTS. If you did not receive a mailer or email with an IDPIN but filed a Homestead Benefit application.

Municipal Prosecutor 201 209-6755 Phone. Listen to prerecorded information on common tax issues. Page 1 of 7277.

You can call the City of Jersey City Tax Assessors Office. Web City Hall 280 Grove Street Room 116 Jersey City NJ 07302 Tel. Municipal Court 201 209-6700 9am - 5pm Mon - Fri Lewis S.

Web Revenue Jersey tax Phone number 01534 440300 Email address jerseytaxgovje Opening hours Monday to Friday 830am to 5pm Address Taxes enquiry desk at Customer. Page 1 of 7276. Mayor Fulop Announces Open Applications for Jersey Citys First Time Homebuyer Program to Assist Low and Moderate-Income.

Web If the assessment on a property is 1 million or below a taxpayer must first file an appeal with the county board of taxation. Description The office of the City. Web 2022 Jersey City Art Studio Tour - JCAST.

Web Jersey City NJ 07302. Web HOW TO PAY PROPERTY TAXES. Mayor Fulop Announces Open Applications for Jersey Citys First Time Homebuyer Program to Assist Low and Moderate-Income.

Web Revenue Jersey tax Phone number 01534 440300 Email address jerseytaxgovje Opening hours Monday to Friday 830am to 5pm Address Taxes enquiry desk at. Web 2022 Jersey City Art Studio Tour - JCAST. Web Homeowners need an ANCHOR ID and PIN to apply online or by phone.

See reviews photos directions phone numbers and more for Property Tax locations in Jersey City NJ. Web When contacting City of Jersey City about your property taxes make sure that you are contacting the correct office. McRae Justice Complex Jersey City NJ 07306.

By Mail - Check or. Jersey New Jersey 07302.

New Jersey Residents Can Now Prepay Their Property Taxes 6abc Philadelphia

Jersey City New Jersey Wikipedia

Jersey City S 2022 Tax Hikes Q3 And Q4 Tax Bill Flux Explained Civic Parent

How Does Your Town S Property Tax Allocation Compare To The State Average R Jerseycity

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Gov Murphy Unveils Anchor Property Tax Relief Program Whyy

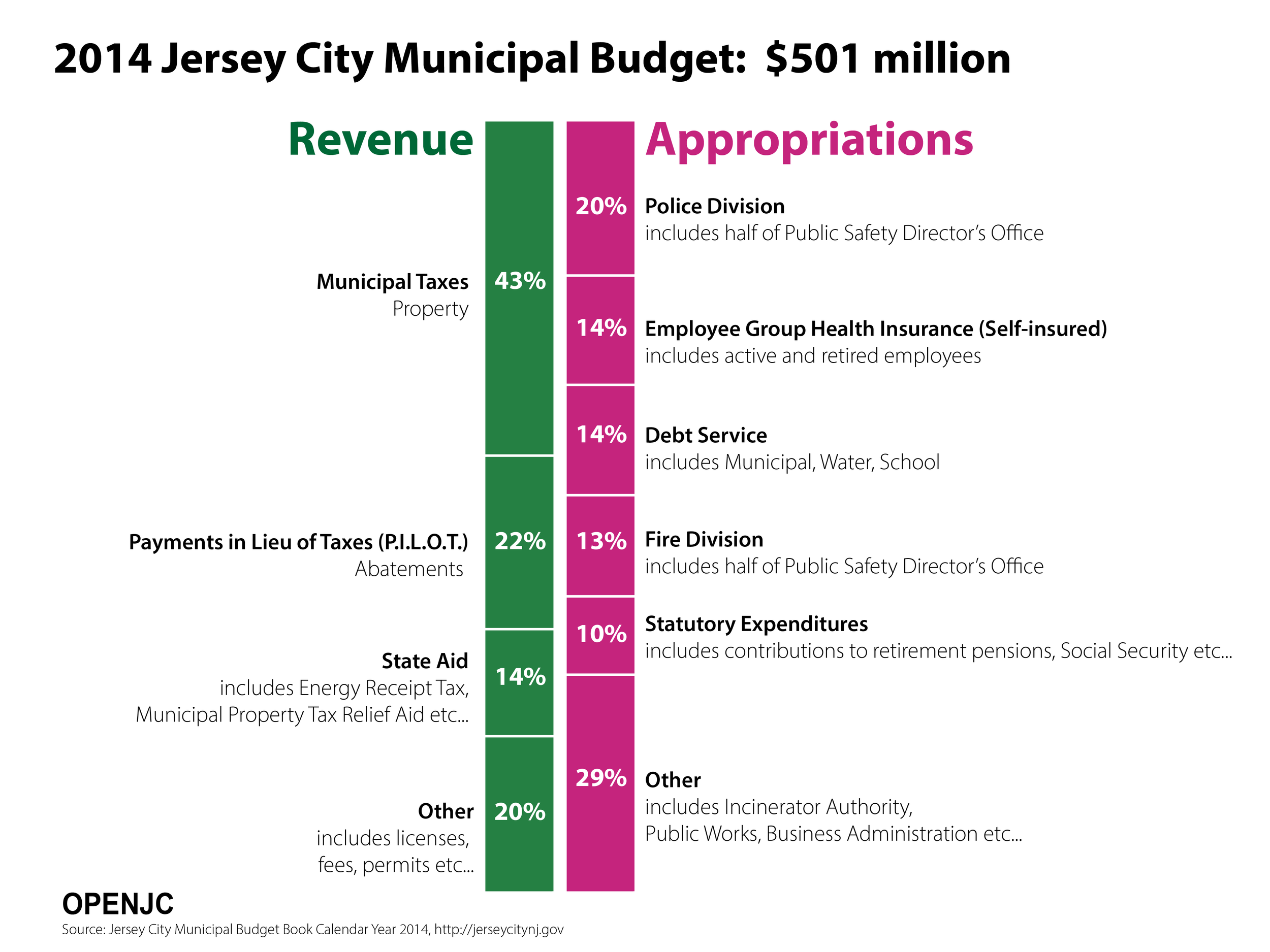

Jersey City 2014 Budget In 4 Easy Graphs Visualizing Economics

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent

What You Need To Know About Your Property Tax Bills

Jersey City Property Owners Can Brace For More Pain In Fourth Quarter Tax Bill

The Official Website Of City Of Union City Nj Tax Department

New Document Provides A Timeline For Jersey City Reval Jersey Digs

Category Cecinini Law Group Llc

Jersey City New Jersey Wikipedia

Jersey City New Jersey Wikipedia

How Much It Costs To Live In New Jersey Versus New York City