what is a secondary property tax levy

A levy is a legal seizure of your property to satisfy a tax debt. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to.

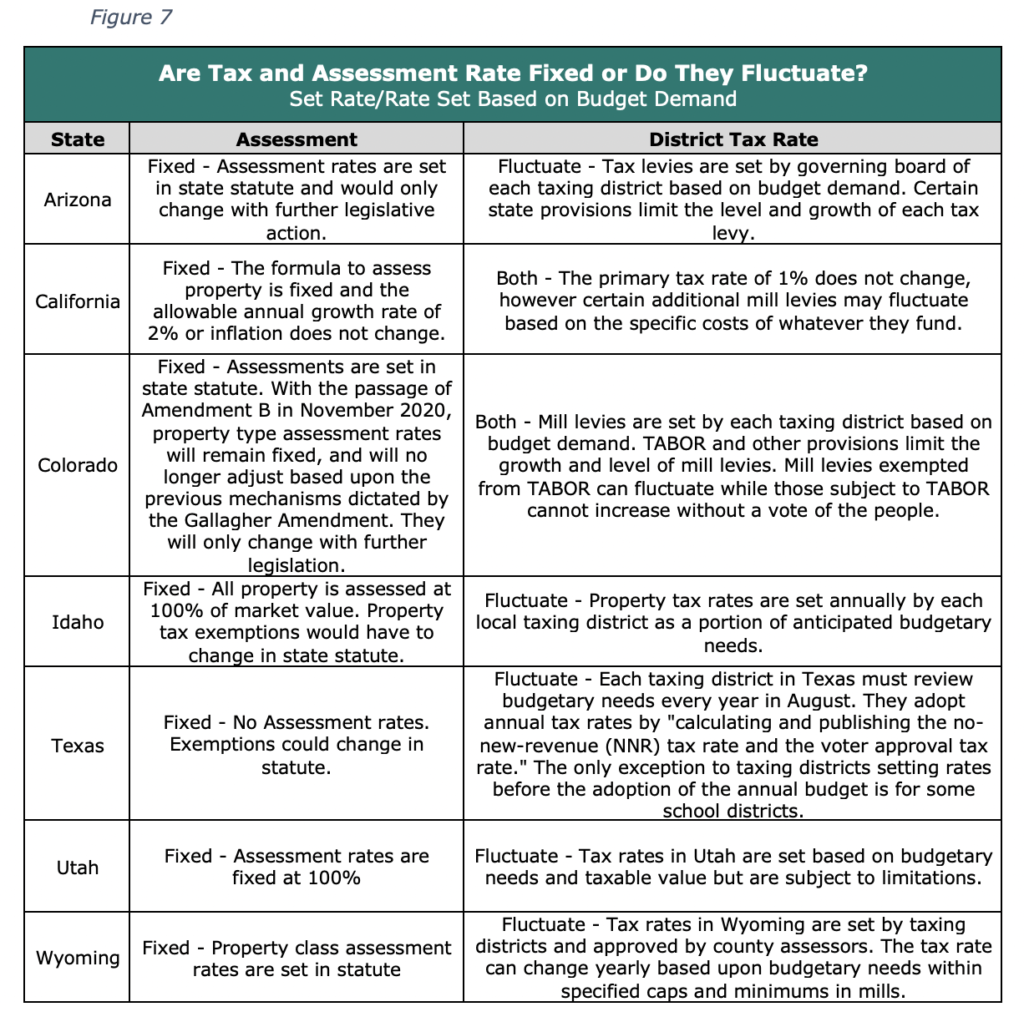

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

It can garnish wages take money in your bank or other financial account seize and sell your vehicle.

. Comprised of the total of the obligation for Special Taxing Districts voter approved bonds and budget overrides that are assessed on valuation. Based On Circumstances You May Already Qualify For Tax Relief. For 2022 there were 48 different taxing districts in Coconino County with a tax levy.

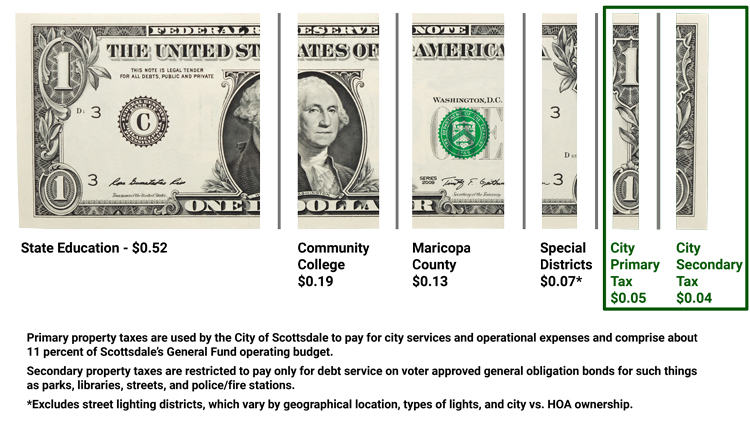

The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation bonds. In other words the levy is the cap on the amount of property. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

Levies are different from liens. Primary Tax Rates fund the maintenance and operation of budgets of state and local government entities. Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on.

Based On Circumstances You May Already Qualify For Tax Relief. An IRS levy permits the legal seizure of your property to satisfy a tax debt. Please find information links and contact details for each of these taxing districts below.

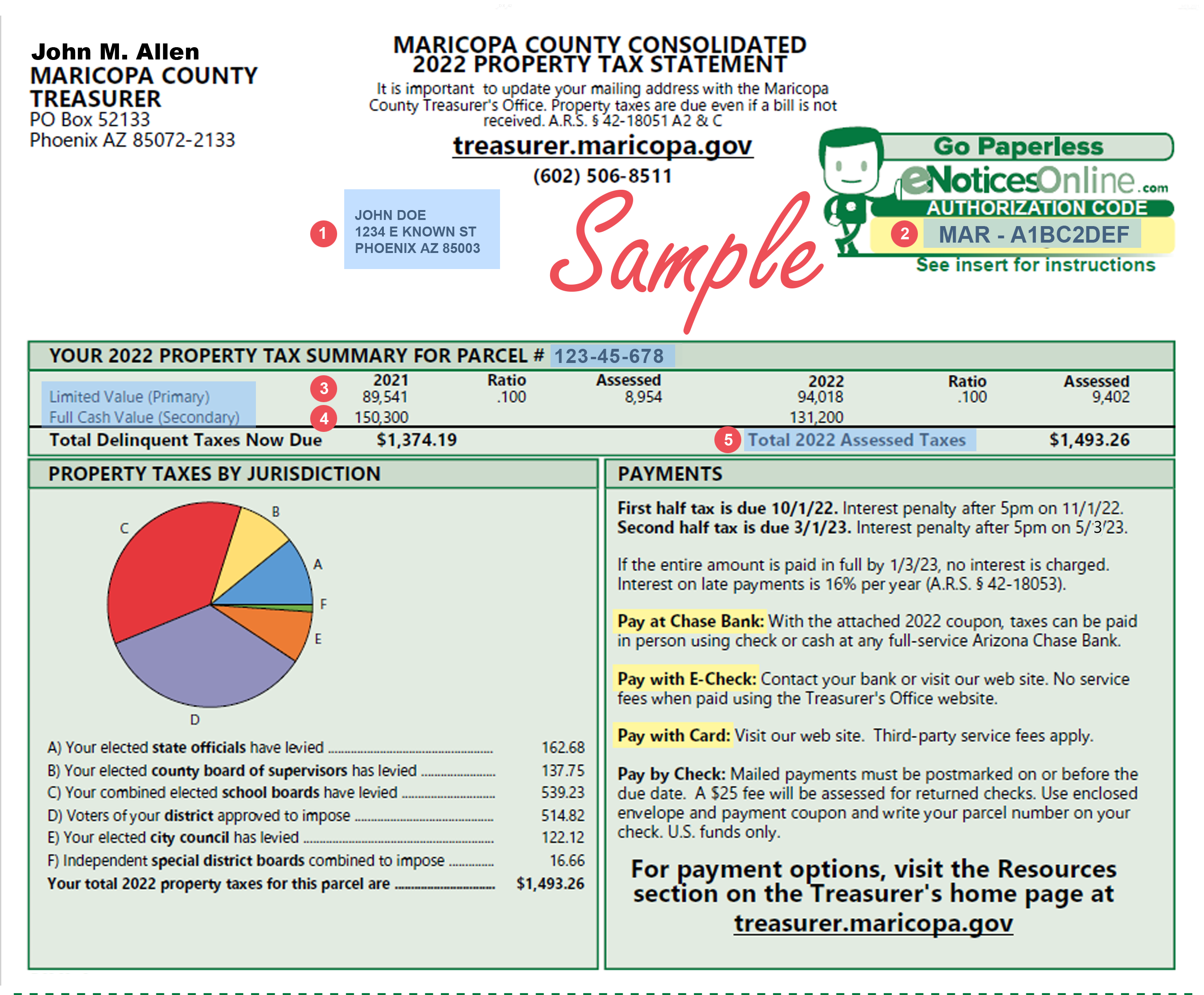

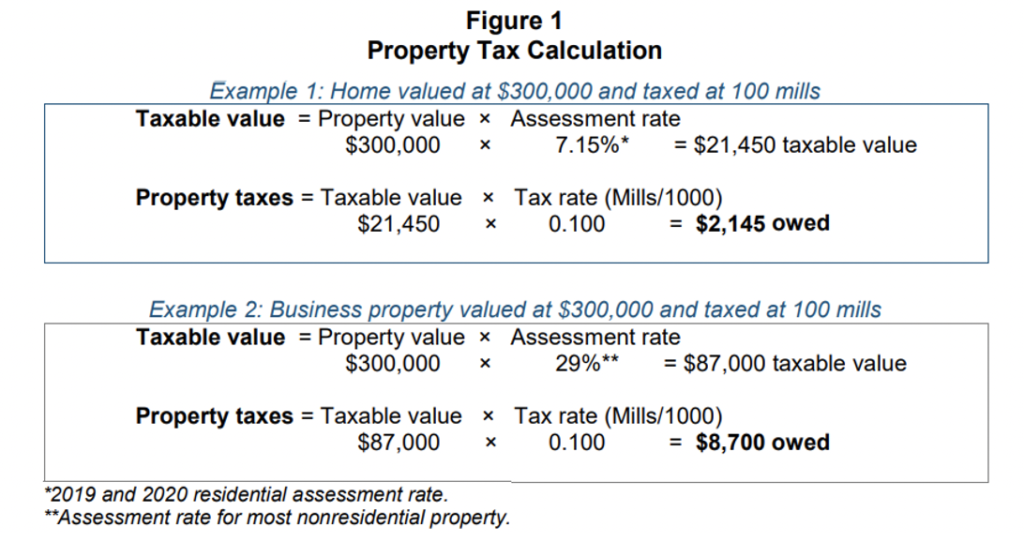

Arizona is unique in that it uses two values and two tax rates for property taxation. A levy is a legal seizure of your property to satisfy a tax debt. A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy.

301 West Jefferson Street Phoenix Arizona 85003 Main Line. What Is A Secondary Property Tax Levy. What is a secondary tax levy.

Secondary Property Tax Levy debt repayment. As indicated previously the secondary tax levy is the voter approved general obligation debt service for each fiscal year. Free Case Review Begin Online.

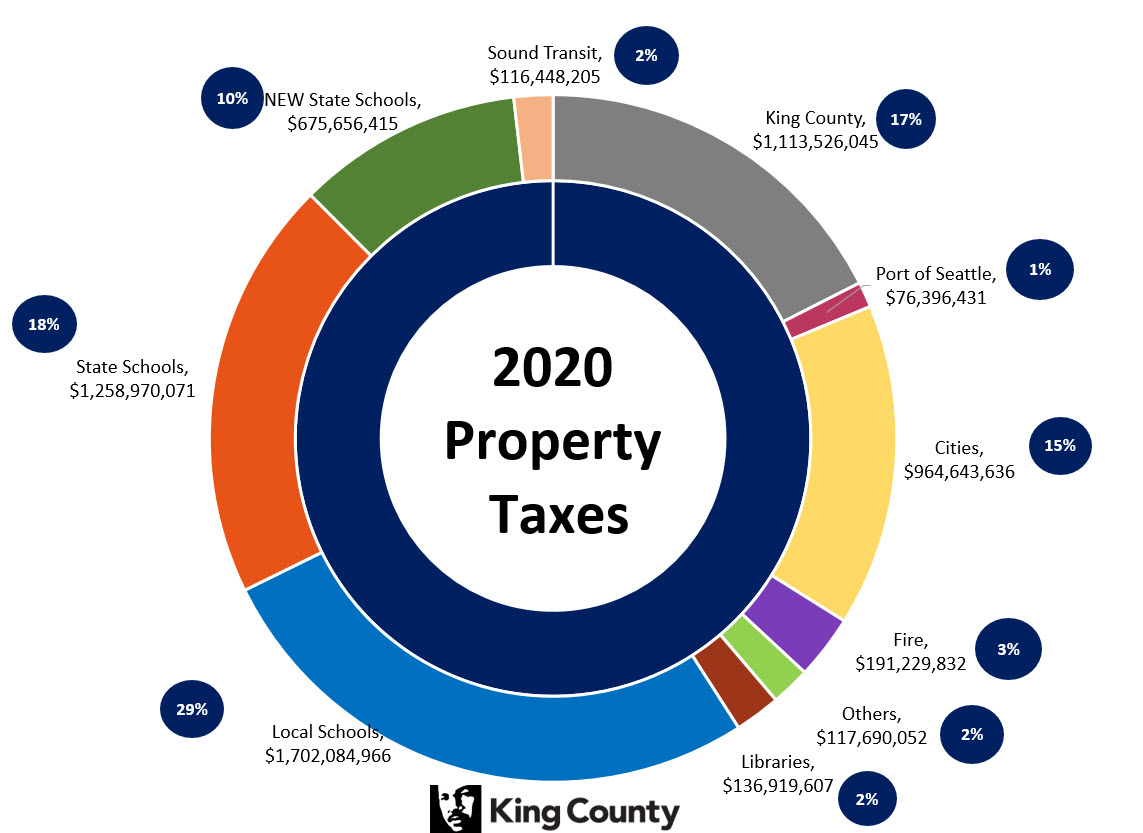

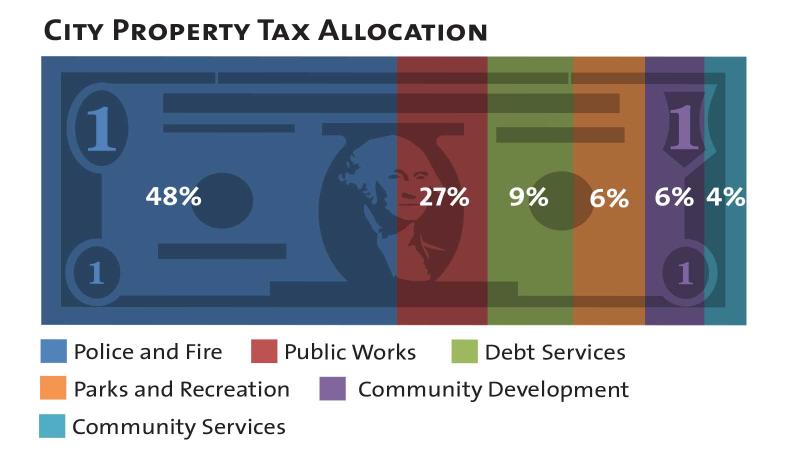

Property taxes are one of the primary if not the only ways for municipalities to raise revenue for community services. The City uses the tax levy not the tax rate to. Free Case Review Begin Online.

Towns and cities use the proceeds from levying property taxes to fund. Ad See If You Qualify For IRS Fresh Start Program. What is an assessed value.

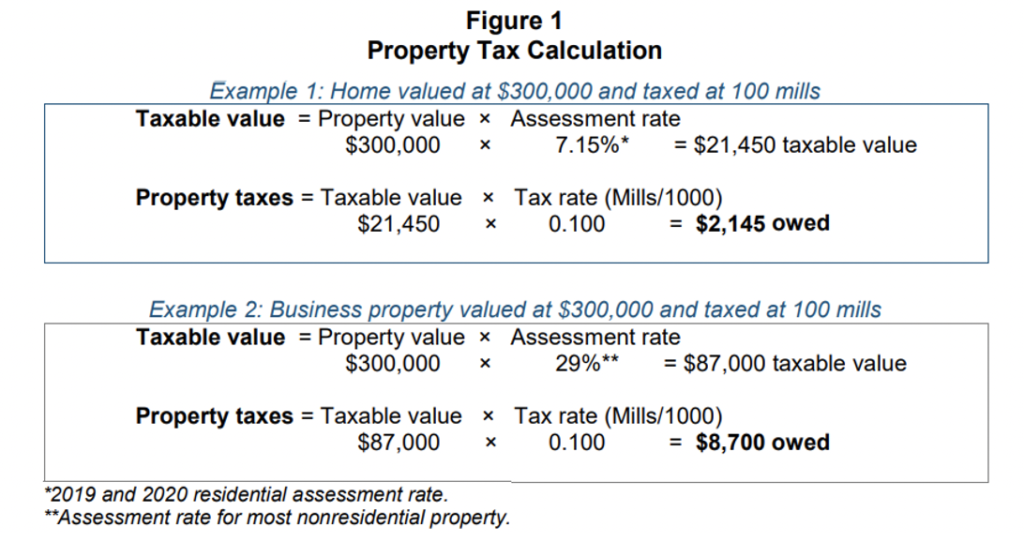

A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district. It is different from a lien while a lien makes a claim to your assets.

Ad See If You Qualify For IRS Fresh Start Program. A lien is a legal claim against property to secure payment of the tax debt while a. Secondary Property Tax SEC.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Council Approves 2022 Tax Levy City Of Bloomington Mn

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

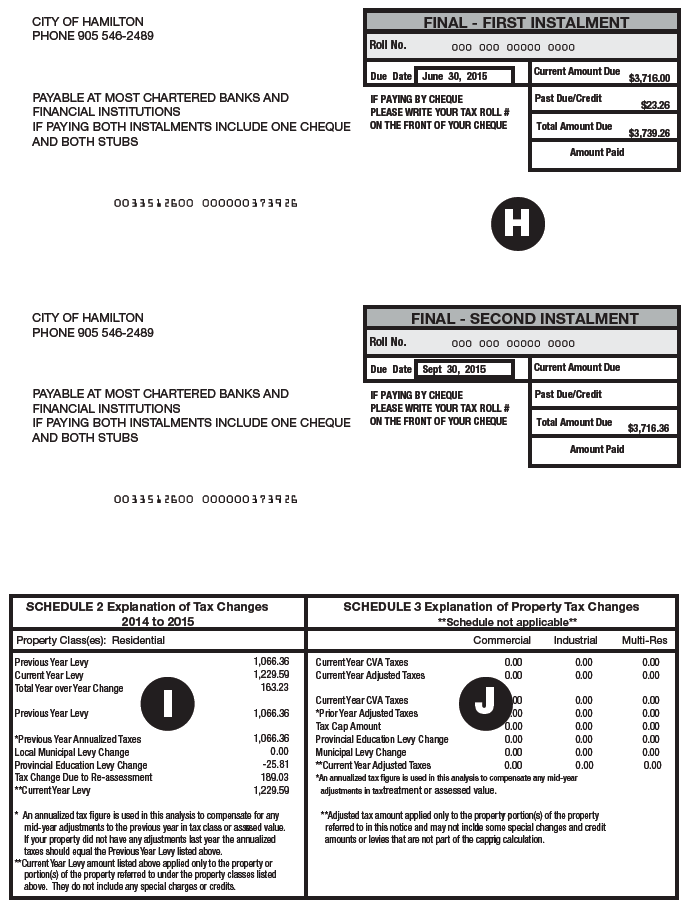

Understanding Your Property Tax Bill City Of Hamilton

City Of Scottsdale City Of Scottsdale Truth In Taxation Notice

Biennial Property Tax Report Texas County Progress

Making Sense Of Maricopa County Property Taxes And Valuations